CRE Terms #26: Occupancy Metrics

When it comes to dealing with stakeholders, one of the key skills every commercial real estate professional needs is the ability to convert the complex concepts and calculations we deal with every day into concise, easy-to-understand metrics.

For those working in the hospitality and multifamily sectors, this can be especially relevant. Keeping stakeholders appraised of seasonal fluctuations and other trends is a must. As is emphasizing strategies to optimize the value of operations in the long-term.

In these cases, it’s often the most straightforward metrics that do the best job of highlighting how an asset is performing, or why it’s not. So, to get the ball rolling on “CRE Terms” in 2024, we’re going back to hospitality and multifamily basics with a deep dive into the terminology around occupancy.

Occupancy rates

The most straightforward occupancy metric, a property’s occupancy rate compares the number of units occupied to total availability. For multifamily properties, the calculation is:

(Number of occupied units / Number of available units) X 100.

So a building with 50 units, of which 34 are occupied would have an occupancy rate of (34/50) X 100 = 68%.

The calculation for hospitality is similar, but works across a different timescale. Occupancy in this case is still measured as (Number of occupied units / Number of available units) X 100 but on a night-by-night basis.

Comparing these occupancy calculations over time gives hotel owners fine-scale insight into which days their property is most popular. Occupancy can also be calculated over a longer period to obtain more information about average performance, and this can be helpful when deciding whether to raise or lower room rates.

Vacancy rate

Calculating a property’s vacancy rate is similarly simple: (Number of vacant units / Number of available units) X 100. Because this is an inverse value, it can also be obtained by using the equation:

Vacancy rate (%) = (1 – Occupancy rate) X 100

So, for our above example, this would be: (1 – 0.68) X 100 = 32%.

Breakeven occupancy

A slightly more nuanced metric, breakeven occupancy, describes the exact point when a property crosses over from an operating deficit to an operating surplus. More specifically, Adventures in CRE defines breakeven occupancy as:

“The occupancy at which the effective gross income is equal to the sum of the operating expenses plus debt service.”

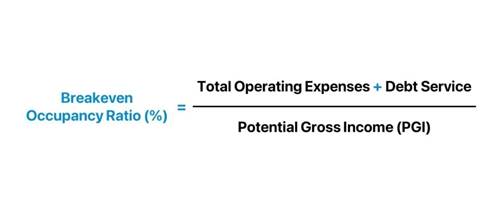

Summed up in a formula, this is:

(Source: Wall Street Prep)

As an example, if a property’s potential gross income is USD25,000 per month, with operating expenses of USD7,500 and USD10, 000 in debt service, breakeven occupancy would be calculated as: (7,500 + 10, 000 / 25, 000) = 70%.

Projected breakeven occupancy can be a valuable tool to discern a property’s potential performance, especially when compared to typical occupancy rates for similar assets. If the breakeven occupancy for a project is very close to the typical occupancy in the area, the property may represent a higher level of risk for investors. But if there’s a wider margin of error, this can be a great metric for demonstrating the safety of an investment.

Additional metrics

In addition to occupancy metrics, CRE professionals across all sectors need to be familiar with a large range of other calculations for determining CRE performance and value. Occupancy itself also ties into additional calculations, like revenue-per-available-room (RevPAR) – the widely used “gold standard” of profitability in the hospitality industry.

Refreshing these concepts, and diving into more detailed ones, can make it easier to communicate the right information to both new prospects and existing clients.

But it’s also worth remembering that while using highly nuanced metrics certainly adds value and depth, sometimes simple is best. The best metric for the job will often be the one that communicates the core information needed to understand a property’s performance in the simplest and clearest terms.

That’s all for this edition of “Terms.” But be sure to check back throughout the year as we delve into more of the calculations, concepts, and terminology central to creating CRE value.