Plain Language 4: Three More CRE Terms & Categories Defined

This blog is the fourth installment of our series on commercial real estate (CRE) terms. The first, second, and third such blog posts can be found on our website.

For today’s round-up of definitions we look at the matter of leasing and delve into some of the trickier aspects that CRE professionals may run into during leasing discussions, agreements, and negotiations.

Letter of Intent (LOI)

A letter of intent or LOI has its place in many different spheres of business and it is simply formalizing the beginning of a contracting relationship. It is not a stand-in for a contract or lease.

The NAIOP likens it to a term sheet or memorandum of understanding (MOU), adding: “While LOIs may not be binding, provisions of them can be, e.g., non-disclosure and exclusivity. The intent is to protect both parties in the transaction until the transaction is executed.”

An LOI for example lends a degree of formality and shared understanding to the old school “gentleman’s agreement”, as if to say “Yes, we shook on it, and this is what that handshake covers”.

50 shades of rent

Much can fall under the innocuous-seeming “rent” label, and there are various ways in which rent can be expressed in an agreement. This means that it is essential all parties know what is being referred to and how that is calculated

- Contract rent is the simplest of the bunch, referring to the rental rates stated within a lease or leasing contract. Typically, the contract will specify a rate for the first year, with provisions on future rates or increase amounts and intervals. NAIOP calls this a synonym for the base rate.

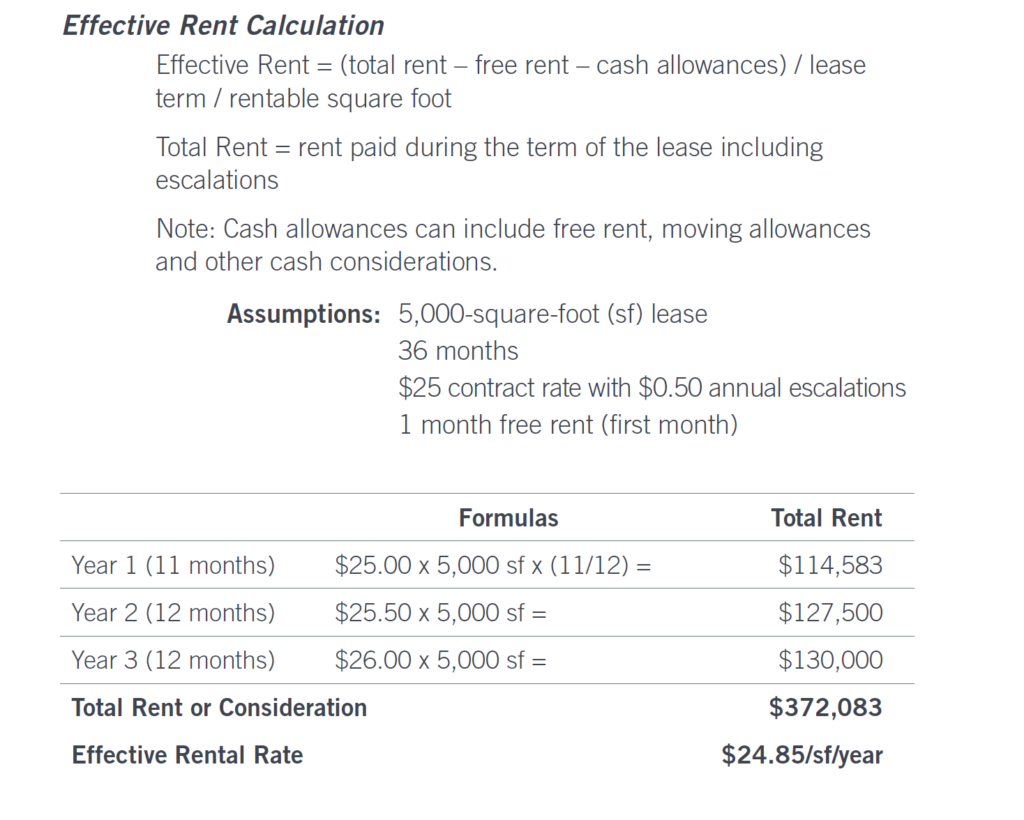

- Effective rent includes any regular or included fees and payments that apply to the rent in question, such as broker commissions. It is often expressed as a ratio, such as dollars per square foot. Sometimes this is stated per year or per rent, according to the typical practice in the geographical area or sector. Below is a screenshot of a typical effective rent calculation, sourced from NAIOP.

- Increasingly we see “straight-line rent” cropping up in leasing discussions. This is a way of simplifying the expression of rent over time as a means of comparison usually. It accounts for things like discounted rates or fixed increases that often crop up in retail rentals, for example. To calculate, add up all the rent income received and divide by the term of the lease.

- Another term that is becoming more mainstream – especially in spaces with typically longer rental terms, such as office and industrial space – is the notion of “blend and extend” leases which allow for extending an existing lease. This is a great negotiation tool for both parties to a lease. Instead of waiting for the expiration of a lease, a blend and extend agreement could be used to secure lower or higher rents through the hand-off of more certainty about lease length. It also is a useful tool in times of economic uncertainty, such as those ushered in by the Covid-19 pandemic.

Want to learn more?

NAIOP is the Commercial Real Estate Development Association, and their NAIOP Research Foundation publishes very useful materials on these kinds of terms, including a PDF of definitions which has been a key source for us in developing these blogs. We recommend it to those looking to brush up on their understanding. The document was published a few years ago – in 2017 – but is still one of the more comprehensive materials we’ve seen on the topic.